Beginning on January 1, 2020, employers have two new types of Health Reimbursement Arrangements that they may choose to offer to their employees.

The first, the Excepted Benefit HRA, is a more limited option that is designed to supplement other benefits and is not considered Minimum Essential Coverage. The second option, an Individual Coverage Health Reimbursement Arrangement, or ICHRA, is considered minimum essential coverage (see Notice 2018-88) and can therefore be part of an employer’s strategy to offer coverage and mitigate risk for employer shared responsibility assessments.

But, to effectively avoid the risk of such assessments, the ICHRA must also prove to be affordable. The IRS has provided proposed rules to allow employers to determine if their Individual Coverage Health Reimbursement Arrangement is affordable. The rules, however, are complicated, and employers will likely want to take advantage of some proposed safe harbors included in the guidance that align with the affordability safe harbors previously included in the ACA requirements. Unlike the previous safe-harbor calculations, however, the ICHRA determinations will need to be made on an employee-by-employee basis, as individual characteristics such as age and primary work location factor into the calculation.

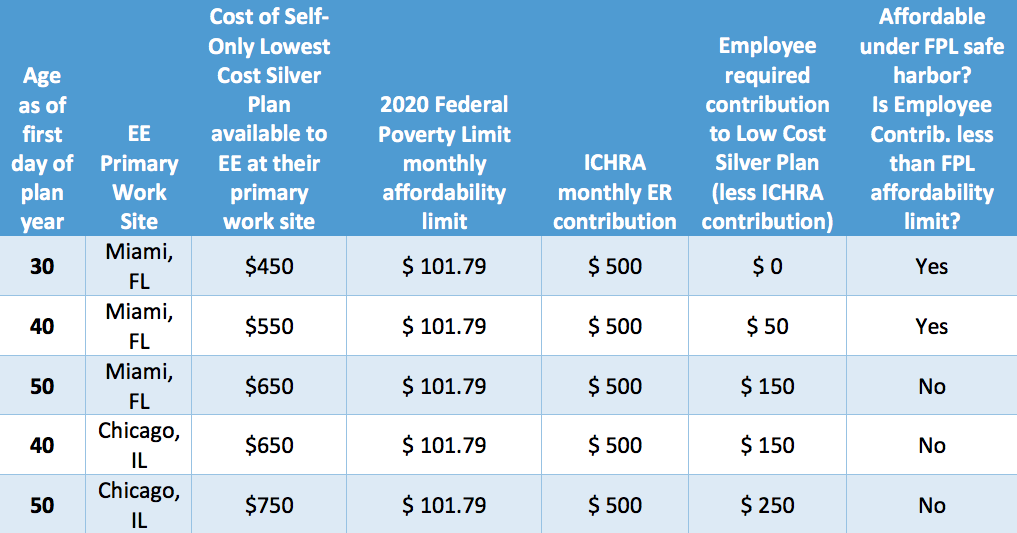

Consider the below example of a Federal Poverty Limit calculation of affordability for a variety of employees:

As can be seen in the above chart, the same employer contribution may be determined to be affordable for some employees in a single location (based upon the premium associated with their age, in that location), but not affordable for other employees. Similarly, differences in premiums based on work location may also impact the affordability of the plan. Additional safe harbors based on the Rate of Pay and W-2 affordability limits are also available—and can add additional individuality and complexity to the calculations.

Employers are permitted to vary their contributions to an ICHRA for different classes of employees, with some restrictions. Within the individual classes, variance by age is permitted (but all contributions for participants of the same age must be the same and the maximum contribution cannot be more than three times that made for the youngest participants). Because these ICHRA plans are considered Minimum Essential Coverage, they must be reported on the employer 1095s.

The proposed rules include a few safe harbors designed to simplify the calculations, such as allowing employers to:

- Use the employee’s age as of the start of the plan year, to simplify age-related calculations

- Use the principle work site instead of the employee’s home address for plan cost info

- Use the monthly self-only premium for the lowest-cost silver plan from January of the prior calendar year (for calendar based plan years) and January of the current calendar year for non-calendar year-based plan years

The proposed rules provide guidance and safe harbor options to employers considering Individual Coverage Health Reimbursement Arrangements to address the need to determine affordability – and while they are complex, they are not unwieldy. I understand that often employers are considering the ICHRA for populations that may not be considered full-time according to the ACA, such that the Employer Shared Responsibility rules may not apply. But for those that are considering the ICHRAs as an opportunity to change the way you provide benefits to your full-time employees, it will be imperative you understand the intricacies of the affordability calculations, and the factors that impact it.

Need more help with compliance? We're here for you!