Earlier this week, we partnered with Employee Benefit News to talk about an issue that is top of mind for our industry – the Affordable Care Act (ACA).

During the presentation, we discussed compliance reporting and the looming deadlines that must be met to finish out 2015, as well as form corrections and tips for improving your game plan so that 2016 reporting is a guaranteed victory.

Joining me for the webinar were ACA experts Ben Conley, Employee Benefits & Executive Compensation Attorney at Seyfarth Shaw, and Angel Hower, product lead for our ACA Compliance Suite℠.

If you weren’t able to listen to the presentation, or are looking for a refresh of what was discussed, keep reading. Below, I’ve shared top insights from the webinar that will guide you through the rest of this reporting season and help you prepare for next year.

- We’re all in this together. ACA compliance and reporting is not just one person’s or one department’s challenge. ACA reporting touches nearly every unit in a company—finance, tax, legal, IT, benefits and Work together with your entire team to get across the finish line.

- We’re on the road to victory. With a March 30 deadline, 1095-B and 1095-C forms have already been delivered to employees. Take a moment to breathe and celebrate this first success! But be ready for what’s next. Companies filing 250 or more returns must submit electronic copies of 1095-B/1095-C and 1094-B/1094-C forms by the fast-approaching deadline of June 30.

- We’re in correction overtime. Before clicking the “transmit” button, conduct another round of audits. It’s a lot easier to regenerate a form when it’s still in your hands versus having to go through the IRS electronic correction process.

- Make sure you have a corrections game plan in place. Some organizations have been surprised to learn that their vendors haven’t been working corrections. If it wasn’t included in the scope of work, it’s not a responsibility required of the vendor. Confirm with your vendor whether or not the corrections process is included as part of their services, and if not, identify a game plan – whether you handle it internally or amend your vendor’s scope of work, be sure someone is on point to manage this critical process.

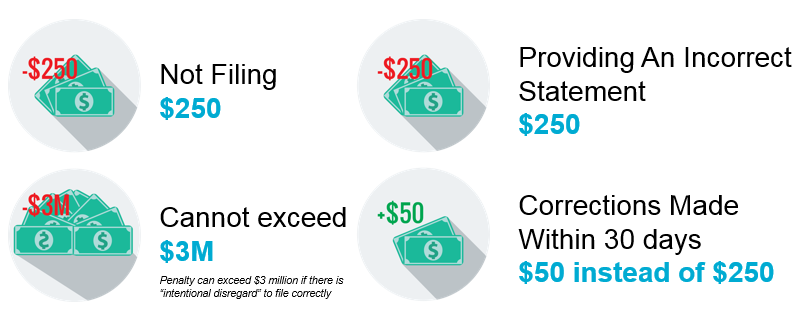

- Penalties add up quickly. There are penalties for failing to file returns on time, failing to include all required information and filing incorrect information. Know the penalties and take them seriously despite this year’s more lenient good faith effort.

- Timely corrections can reduce penalties. Working corrections may seem tedious, but doing so in a timely matter can save you from paying the full penalty price tag. Correcting a reporting failure within 30 days of the due date reduces the penalty to $50 per return with a cap of $500,000. For reporting failures corrected after 30 days but on or before August 1 of the filing year, the penalty is $100 per return and the cap is $1.5 million.

.png)